Gold Daily

Gold Weekly

Gold set out creating a lower bear flag on Monday and just sat there, flipping from 1195 support to being resistance. The weekly chart shows that this is bearish going forward as it fell out of the upward channel, but is still holding support of the 20wk SMA, barely. Look for a test of 1179 from the daily range. If that fails 1143 is the next support and then 1116 from the weekly chart. If 1179-1183 holds then a retest of resistance at 1207 could happen.

Gold set out creating a lower bear flag on Monday and just sat there, flipping from 1195 support to being resistance. The weekly chart shows that this is bearish going forward as it fell out of the upward channel, but is still holding support of the 20wk SMA, barely. Look for a test of 1179 from the daily range. If that fails 1143 is the next support and then 1116 from the weekly chart. If 1179-1183 holds then a retest of resistance at 1207 could happen.West Texas Intermediate Crude Daily

West Texas Intermediate Crude Weekly

After holding the new higher range 76-82 oil kept plugging away at the 100 day SMA breaking through it and the 200 SMA on Thursday. Friday confirmed the break above the 200 SMA and a move into the top of the range. It now has a chance to run higher to 82. The tightly bound SMA's on the weekly chart will act as support, with resistance above 82 at 87.

After holding the new higher range 76-82 oil kept plugging away at the 100 day SMA breaking through it and the 200 SMA on Thursday. Friday confirmed the break above the 200 SMA and a move into the top of the range. It now has a chance to run higher to 82. The tightly bound SMA's on the weekly chart will act as support, with resistance above 82 at 87.US Dollar Index Daily

US Dollar Index Weekly

The dollar index held the 82 support level on Monday but probed it 3 days this week. Wednesday's strong push higher was beaten back and more on Thursday. The weekly chart shows a long run down to support at 82.25. The weekly suggests that it will go lower as the MACD is just getting started and the RSI indicates it is not oversold. Watch for support at 81.42 if it fails here. The 83.52 area is resistance if it bounces.

The dollar index held the 82 support level on Monday but probed it 3 days this week. Wednesday's strong push higher was beaten back and more on Thursday. The weekly chart shows a long run down to support at 82.25. The weekly suggests that it will go lower as the MACD is just getting started and the RSI indicates it is not oversold. Watch for support at 81.42 if it fails here. The 83.52 area is resistance if it bounces.VIX Daily

VIX Weekly

The Volatility Index appears to be bouncing like a superball (each bounce has a lower high) off of the 23.50 area creating a descending triangle pattern. Note that the 23.50 level represents that volatility has been elevated since the beginning of May. From a technical analysis perspective the VIX appears to be headed lower. If that happens it would create an atmosphere where price gains in stocks would be easier to achieve. Keep that in mind.

The Volatility Index appears to be bouncing like a superball (each bounce has a lower high) off of the 23.50 area creating a descending triangle pattern. Note that the 23.50 level represents that volatility has been elevated since the beginning of May. From a technical analysis perspective the VIX appears to be headed lower. If that happens it would create an atmosphere where price gains in stocks would be easier to achieve. Keep that in mind.SPY 60 minute

SPY Daily

SPY Weekly

SPY is trying to change the trend from down to up. The 60 minute SPY chart shows that there is a lot of congestion between the 110.41 close and 112 with several instances of resistance and support in between. The daily chart confirms a break of the downtrend lines and a near touch of the 200 day SMA at 110.68 which could give resistance. The weekly chart shows a move higher with resistance at 112.21 the 20wk SMA. SPY is in a transition phase. If it continues up to 112 the trend will have changed top rising and look to 113.2, the June highs, as resistance. If it gets knocked back 108.40 looks to be support.

SPY is trying to change the trend from down to up. The 60 minute SPY chart shows that there is a lot of congestion between the 110.41 close and 112 with several instances of resistance and support in between. The daily chart confirms a break of the downtrend lines and a near touch of the 200 day SMA at 110.68 which could give resistance. The weekly chart shows a move higher with resistance at 112.21 the 20wk SMA. SPY is in a transition phase. If it continues up to 112 the trend will have changed top rising and look to 113.2, the June highs, as resistance. If it gets knocked back 108.40 looks to be support.IWM Daily

IWM Weekly

Strongest of the Index ETF's. The IWM saw a strong move higher to resistance at 65 over the last 4 days, through the 200day and 50 day SMA's. It now sits just above the 200wk SMA at 64.73 and looks to be heading for 66.50-.71 as resistance from both the daily and weekly charts and support below at 62.23-.52. Small caps leading higher.

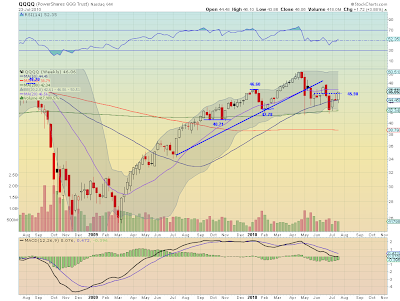

Strongest of the Index ETF's. The IWM saw a strong move higher to resistance at 65 over the last 4 days, through the 200day and 50 day SMA's. It now sits just above the 200wk SMA at 64.73 and looks to be heading for 66.50-.71 as resistance from both the daily and weekly charts and support below at 62.23-.52. Small caps leading higher.QQQQ Daily

QQQQ Weekly

The Q's are the weakest of the Index ETF's. The daily chart shows that the rally ended just at the downtrend line from early May. The weekly shows that it broke the 45.90 resistance level but is in a resistance range now topped at 46.60. This resistance is confirmed on the daily chart near 46.70. If it rejects this resistance are the support area below is 45.13-.30 first and then 44.45. Given the outlook on the VIX and the other Indexes the bias would be for a break higher.

The Q's are the weakest of the Index ETF's. The daily chart shows that the rally ended just at the downtrend line from early May. The weekly shows that it broke the 45.90 resistance level but is in a resistance range now topped at 46.60. This resistance is confirmed on the daily chart near 46.70. If it rejects this resistance are the support area below is 45.13-.30 first and then 44.45. Given the outlook on the VIX and the other Indexes the bias would be for a break higher.SO we enter next week with Gold looking weaker and oil looking stronger. The dollar index seems to be in limbo and equity Index ETF's seem to be poised to move higher with support of a VIX looking to move lower. Individual names will come over the course of the weekend and Top 10 Ideas Sunday. Have a great weekend!

No comments:

Post a Comment