1. Endo Pharmaceuticals Holdings, Ticker: ENDP

If it gets above the triangle at 24.85 then there is some resistance at 26 but a target of 32. Support lower on a rejection of the triangle bound is massive, as all 4 SMA 20/50/100/200 and the triangle triangle bottom.

2. RINO International Corp, Ticker: RINO

Could not get above the 15.50 top from June and now it is looking for support at the 50SMA 13.13. This is the potential entry point. If it holds it should re-challenge the 15.50 top, with 12 below as support.

3. Caribou Coffee Co., Ticker: CBOU

Flagging above the recent 10.52 resistance. Now it is ready to pop to 11.50 resistance then 12.90 both from near the issuance 5years ago. Support is at 9.73 below and then the 10.52 area.

4. Crocs, Ticker: CROX

Broke the 12.28 resistance level so ready for higher. The RSI says it is getting overbought as it is above 70 but it can stay overbought for sometime and there is no resistance until 15.49. Support below is at 12.28 then 11.30.

5. Anadarko Petroleum Corp, Ticker: APC

It reclaimed and is holding a range between 49.08, the Resistance/Support line, and the 50.52 area. Could break either way. Above 50.52 the first resistance is at 55 and then 56.68. A break below 49.08 sees support at 44.95. Nearly 10% either way. August 49/50 split straddles went out at 4.26, anticipating this move will happen. Better return in the stock.

6. American International Group, Ticker: AIG

It is holding the break above the descending triangle well. There is resistance 40 then 42.5 above. Then the real money kicks in. Support lower is at 36.06.

7. Jefferies Group, Ticker: JEF

There is a flag forming after the recent move higher, ranging between the 100 and 200SMA, 24.16 and 24.81. Looks like it will break higher. The target on a break is 27.50. There is support below at 24 then 22.79.

8. Emulex Corp, Ticker: ELX

8.70 has been a big area of support in the past and it is testing it now. On a break lower the first support is at 7.75 followed by 7.26. Resistance is at 9.90 if it bounces.

9. NCR Corp, Ticker: NCR

It rejected 14.35 last week and is now looking for support at 13.42. If it finds it there and holds resistance is at 14.35 for a 7% win.

10. Research in Motion, Ticker: RIMM

It broke above the 50SMA Friday and finished at resistance near 57.5 and filled the gap down from late June. it is ready for a move higher now to the 63.20-63.86 resistance area. Support below is at the 50SMA at 55.25.

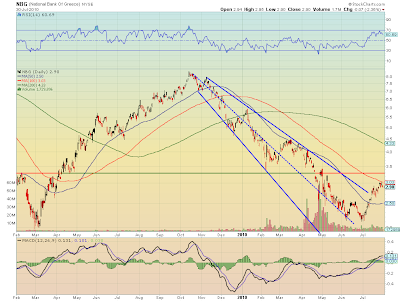

Bonus Idea: National Bank of Greece, Ticker: NBG

Come on, all of the European banks are okay and the National Bank of Greece is rising. You have to be kidding me. This at the top of a Dead Cat Bounce at the 100SMA. RSI is falling and the MACD is rolling over. Target is 2.50 or the 50 SMA whichever is lower.

No Top 10 List next week as I will be taking a short vacation. Back the following week. Trade'm well!