Gold Daily

Gold Weekly

Gold has been on a tear. Today it tagged 1300 and then pulled back slightly. It could rest here as the Relative Strength Index (RSI) is getting overbought. It still looks good for more upside from the clear uptrend channel on the weekly chart. 1345 looks to be the next resistance from a projection off of that weekly chart. Support can be found at 1270 and then 1255.

Gold has been on a tear. Today it tagged 1300 and then pulled back slightly. It could rest here as the Relative Strength Index (RSI) is getting overbought. It still looks good for more upside from the clear uptrend channel on the weekly chart. 1345 looks to be the next resistance from a projection off of that weekly chart. Support can be found at 1270 and then 1255.West Texas Intermediate Crude Daily

West Texas Intermediate Crude Weekly

West Texas Intermediate Crude has been caught in the tangle of the Simple Moving Averages (SMAs) which are acting as both resistance and support on the daily charts. The flat-lined Moving Average Convergence Divergence (MACD) and RSI right at 50 on both the daily and weekly charts indicate no clear trend, but the weekly chart shows a very slight up trend. When Oil gets clear of the SMA's it should make a nice move, the question now is when and which way.

West Texas Intermediate Crude has been caught in the tangle of the Simple Moving Averages (SMAs) which are acting as both resistance and support on the daily charts. The flat-lined Moving Average Convergence Divergence (MACD) and RSI right at 50 on both the daily and weekly charts indicate no clear trend, but the weekly chart shows a very slight up trend. When Oil gets clear of the SMA's it should make a nice move, the question now is when and which way.US Dollar Index Daily

US Dollar Index Weekly

The US Dollar Index is having a horrible run as a result of the Treasury printing presses. This week the wounds reopened and the bleeding picked up. It is now through all major SMA's and looking for support at 79 with the next support lower at 78. Resistance (we can dream can't we?) can be found now at 79.50 and then 80. The weekly chart shows a very disturbing pick up in the negative MACD indicator this week making matters worse.

The US Dollar Index is having a horrible run as a result of the Treasury printing presses. This week the wounds reopened and the bleeding picked up. It is now through all major SMA's and looking for support at 79 with the next support lower at 78. Resistance (we can dream can't we?) can be found now at 79.50 and then 80. The weekly chart shows a very disturbing pick up in the negative MACD indicator this week making matters worse.iShares Barclays 20+ Yr Treasury Bond Fund Daily

iShares Barclays 20+ Yr Treasury Bond Fund Weekly

US Treasuries, as proxied by TLT, seem to be drifting around. I redraw these lines more frequently than any other chart. It looks to be on support of the uptrend from April at 103.50 from the daily chart. Support below that would come at 102.50 and then lower at 102. Resistance can be found at 104.06 followed by 104.80. The RSI is right at 50 and the MACD can't make up it's mind either as it looks the slower and faster signals look like they are repelling each other as they come close to a cross. The weekly chart looks like it is losing the uptrend, barely, or perhaps filling the gap from 6 weeks ago before a run higher. Blowing in the wind.

US Treasuries, as proxied by TLT, seem to be drifting around. I redraw these lines more frequently than any other chart. It looks to be on support of the uptrend from April at 103.50 from the daily chart. Support below that would come at 102.50 and then lower at 102. Resistance can be found at 104.06 followed by 104.80. The RSI is right at 50 and the MACD can't make up it's mind either as it looks the slower and faster signals look like they are repelling each other as they come close to a cross. The weekly chart looks like it is losing the uptrend, barely, or perhaps filling the gap from 6 weeks ago before a run higher. Blowing in the wind.VIX Daily

VIX Weekly

The Volatility Index has been in a range between 21.25 and 28.40 for nearly three months and looks to continue that way next week. All of the SMA's are within the range on the daily and most are looking like flat lines now, acting as resistance on the way to the top of the range.

The Volatility Index has been in a range between 21.25 and 28.40 for nearly three months and looks to continue that way next week. All of the SMA's are within the range on the daily and most are looking like flat lines now, acting as resistance on the way to the top of the range.SPY 60 minute

SPY Daily

SPY Weekly

The 60 minute chart on the SPY shows that it is now clear of a lot of the resistance and support areas from the past four months and can look to new higher levels if it can hold up. The daily chart shows a strong up move today that stopped right at the 114.84 area that was some support just after the May 6 flash crash. Above that are there is resistance at 116.50 and below is support at 112.61 and then 109.87. The RSI is pointing higher and the MACD is now increasing again. It looks higher. Switching to the weekly chart, the SPY cleared the 200 week SMA today at 114.69. here is a good uptrend developing and RSI and MACD are supporting further advancement. Resistance shows up at 118.50 and then 120.89 on the weekly.

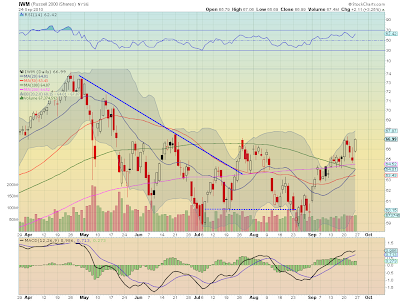

The 60 minute chart on the SPY shows that it is now clear of a lot of the resistance and support areas from the past four months and can look to new higher levels if it can hold up. The daily chart shows a strong up move today that stopped right at the 114.84 area that was some support just after the May 6 flash crash. Above that are there is resistance at 116.50 and below is support at 112.61 and then 109.87. The RSI is pointing higher and the MACD is now increasing again. It looks higher. Switching to the weekly chart, the SPY cleared the 200 week SMA today at 114.69. here is a good uptrend developing and RSI and MACD are supporting further advancement. Resistance shows up at 118.50 and then 120.89 on the weekly.IWM Daily

IWM Weekly

The daily chart of the IWM shows a strong move up to resistance at 67 today with further resistance at 67.50 and then 70 higher. Support can be found at 66 and lower at 65.50. This also looks to be headed higher with the MACD and RSI supporting the bull case. On the weekly chart IWM broke above the downtrend line now sees similar resistance levels as the daily at 67.60 and then 70. Support can be found on the weekly at 64.66 and then lower at 64.19. IWM is now above all of its major SMA's on both the daily and the weekly charts.

The daily chart of the IWM shows a strong move up to resistance at 67 today with further resistance at 67.50 and then 70 higher. Support can be found at 66 and lower at 65.50. This also looks to be headed higher with the MACD and RSI supporting the bull case. On the weekly chart IWM broke above the downtrend line now sees similar resistance levels as the daily at 67.60 and then 70. Support can be found on the weekly at 64.66 and then lower at 64.19. IWM is now above all of its major SMA's on both the daily and the weekly charts.QQQQ Daily

QQQQ Weekly

The QQQQ's have been the beast of the equity indexes lately leading the bull charge, and the Three Advancing White Soldiers (actually four) on the weekly chart bode for more to come. Resistance on the daily chart shows up at 50 and then 50.4 higher. there is support at 49.10 and then 48.3 below. RSI is getting into the overbought range on the daily so it may rest and let the SPY and IWM catch up. But it appears the April highs are in sight very soon. This too is above all of its SMA's on both charts.

The QQQQ's have been the beast of the equity indexes lately leading the bull charge, and the Three Advancing White Soldiers (actually four) on the weekly chart bode for more to come. Resistance on the daily chart shows up at 50 and then 50.4 higher. there is support at 49.10 and then 48.3 below. RSI is getting into the overbought range on the daily so it may rest and let the SPY and IWM catch up. But it appears the April highs are in sight very soon. This too is above all of its SMA's on both charts.So next week looks to bring stronger prices for Gold again and more flogging of the US Dollar Index. US Treasury Bonds seem to change direction with changes in sentiment and Oil looks to be stagnating. The relatively low and stable volatility index combined with that weaker dollar create a fertile environment for stocks to continue higher. Good luck next week!

No comments:

Post a Comment