Gold Daily

Gold Weekly

Gold raced up to test the 1255 resistance level and then pulled back to 1245 support on Thursday. The support level held on Friday but the Moving Average Convergence Divergence (MACD) is now crossing on the daily chart, indicating an open environment to pullback further. There is support at 1237, 1233 and 1220. the weekly chart looks like a glass ceiling at 1255 which it cannot crack. If it can there is resistance at 1328 higher. I still expect it to reach new highs, but it may pullback first.

Gold raced up to test the 1255 resistance level and then pulled back to 1245 support on Thursday. The support level held on Friday but the Moving Average Convergence Divergence (MACD) is now crossing on the daily chart, indicating an open environment to pullback further. There is support at 1237, 1233 and 1220. the weekly chart looks like a glass ceiling at 1255 which it cannot crack. If it can there is resistance at 1328 higher. I still expect it to reach new highs, but it may pullback first.West Texas Intermediate Crude Daily

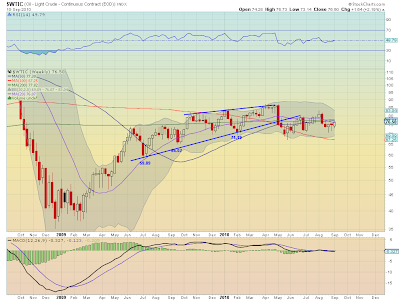

West Texas Intermediate Crude Weekly

West Texas Intermediate Crude seems to be breaking out of the 3 week flag to the upside. I have noted in the past that if it did there is a lot of resistance from both the daily and weekly charts at the Simple Moving Average (SMA) levels above. Friday oil blew through he flag resistance at 75.80, now support, and stopped right at the 50/100 day SMA cross near 76.50. The weekly set of SMA's are also very near by now as resistance at 77.30-.82. There is resistance higher at 77.78 on the daily chart and support lower at 74.80-75. Above the bands of SMA's the weekly chart shows resistance at 81.50 and also adds support lower at 72 and then 71.19. I expect it might take some time to get through this resistance but expect a big pop if it happens quickly.

West Texas Intermediate Crude seems to be breaking out of the 3 week flag to the upside. I have noted in the past that if it did there is a lot of resistance from both the daily and weekly charts at the Simple Moving Average (SMA) levels above. Friday oil blew through he flag resistance at 75.80, now support, and stopped right at the 50/100 day SMA cross near 76.50. The weekly set of SMA's are also very near by now as resistance at 77.30-.82. There is resistance higher at 77.78 on the daily chart and support lower at 74.80-75. Above the bands of SMA's the weekly chart shows resistance at 81.50 and also adds support lower at 72 and then 71.19. I expect it might take some time to get through this resistance but expect a big pop if it happens quickly.US Dollar Index Daily

US Dollar Index Weekly

The US Dollar Index popped to the 20/50 day SMA cross and held there all week. There is resistance higher at 83.50 and then 84 and support lower at 82 all from the daily chart. The flat MACD and RSI give no clue to a future move. The weekly chart shows the beginning of a flag forming above the 82.08 support level. It also shows resistance at 83 and then 84.01 higher and support at 81.64and then 80.58. There might be a slight bias to the upside from the weekly chart with the rising SMA's and hold of support.

The US Dollar Index popped to the 20/50 day SMA cross and held there all week. There is resistance higher at 83.50 and then 84 and support lower at 82 all from the daily chart. The flat MACD and RSI give no clue to a future move. The weekly chart shows the beginning of a flag forming above the 82.08 support level. It also shows resistance at 83 and then 84.01 higher and support at 81.64and then 80.58. There might be a slight bias to the upside from the weekly chart with the rising SMA's and hold of support.iShares Barclays 20+ Yr Treasury Bond Fund Daily

iShares Barclays 20+ Yr Treasury Bond Fund Weekly

My proxy for US Treasury Bonds, the TLT, jumped up Tuesday and proceeded top fall the rest of the week. It ended the week holding support of the 101.77-102.10 area. There is support lower at 100 and then 98. If it catches a bounce resistance can be found at 104 followed by 104.8 and 106. The weekly chart filled the gap from early August and and looks to be headed lower. It adds 102 as a support level and resistance higher at 108. The trend is clearly lower now.

My proxy for US Treasury Bonds, the TLT, jumped up Tuesday and proceeded top fall the rest of the week. It ended the week holding support of the 101.77-102.10 area. There is support lower at 100 and then 98. If it catches a bounce resistance can be found at 104 followed by 104.8 and 106. The weekly chart filled the gap from early August and and looks to be headed lower. It adds 102 as a support level and resistance higher at 108. The trend is clearly lower now.VIX Daily

VIX Weekly

The Volatility Index held support of the bottom of its channel at 21.80, barely. There is support lower at 18 from the daily chart and 16.93 from the weekly. If it continues to hold there is resistance at the 200, 50 and then 100 day SMA's on the way to 28.40 on the daily chart. On the weekly chart adds resistance at 23.88 then 26.09 and 28. It looks to test the bottom of both channels again.

The Volatility Index held support of the bottom of its channel at 21.80, barely. There is support lower at 18 from the daily chart and 16.93 from the weekly. If it continues to hold there is resistance at the 200, 50 and then 100 day SMA's on the way to 28.40 on the daily chart. On the weekly chart adds resistance at 23.88 then 26.09 and 28. It looks to test the bottom of both channels again.SPY 60 minute

SPY Daily

SPY Weekly

Although the SPY looks to be heading to a test of the 113.20 channel top, the 60 minute chart exhibited a bearish divergence between the price action and the MACD this week. It does look like it may resolve shortly and did not show up in the RSI so it is just a point of note right now. The daily chart printed an Inside Day today, a sign of indecision, with 111.19 as support and then 110.27 and 109.40 lower. It shows resistance at 112 and then 113.20. the weekly chart adds to the picture with a bullish move above the 20/50 week SMA cross above 110. It adds a resistance point higher at 114.67 and support lower at 106 and then 104.35. There is more room still to the upside.

Although the SPY looks to be heading to a test of the 113.20 channel top, the 60 minute chart exhibited a bearish divergence between the price action and the MACD this week. It does look like it may resolve shortly and did not show up in the RSI so it is just a point of note right now. The daily chart printed an Inside Day today, a sign of indecision, with 111.19 as support and then 110.27 and 109.40 lower. It shows resistance at 112 and then 113.20. the weekly chart adds to the picture with a bullish move above the 20/50 week SMA cross above 110. It adds a resistance point higher at 114.67 and support lower at 106 and then 104.35. There is more room still to the upside.IWM Daily

IWM Weekly

IWM also had an indecisive Inside Day, finishing below resistance at 64.33 with 64.91 as resistance higher. There is support below at 62.83-63 and then 61.84 from the rising 50 day and 20 day SMA's, respectively. It looks good to go higher still. The weekly chart shows the range between the SMA's and 58.68 holding up with this week's candle squeezed by the 20, 50 and 200 week SMA's. There is resistance higher on the weekly chart at 67.50, and support lower at 61 before testing 58.68. The MACD on the weekly looks to be turning and crossing adding to the bull case.

IWM also had an indecisive Inside Day, finishing below resistance at 64.33 with 64.91 as resistance higher. There is support below at 62.83-63 and then 61.84 from the rising 50 day and 20 day SMA's, respectively. It looks good to go higher still. The weekly chart shows the range between the SMA's and 58.68 holding up with this week's candle squeezed by the 20, 50 and 200 week SMA's. There is resistance higher on the weekly chart at 67.50, and support lower at 61 before testing 58.68. The MACD on the weekly looks to be turning and crossing adding to the bull case.QQQQ Daily

QQQQ Weekly

The Q's also had an Inside Day but well above the 100/200 day SMA cross. There is support at the 45.18-.25 area and then 44.50 below that. Resistance comes first at 46.75 and then 47.10 followed by 47.60. The Q's crossed the 20 week SMA on the weekly chart which will now act as support. There is further support lower at 45.19 and 43.80. Resistance occurs at 46.60 and then 47.20 and 47.60 on the weekly chart. It must get through all those points to have a chance at changing the trend from flat to up. It is a bit troubling that the 20 Week SMA is about to cross down trough the 50 week SMA with the other SMA's flat. There is some room higher but keep an eye on that cross.

The Q's also had an Inside Day but well above the 100/200 day SMA cross. There is support at the 45.18-.25 area and then 44.50 below that. Resistance comes first at 46.75 and then 47.10 followed by 47.60. The Q's crossed the 20 week SMA on the weekly chart which will now act as support. There is further support lower at 45.19 and 43.80. Resistance occurs at 46.60 and then 47.20 and 47.60 on the weekly chart. It must get through all those points to have a chance at changing the trend from flat to up. It is a bit troubling that the 20 Week SMA is about to cross down trough the 50 week SMA with the other SMA's flat. There is some room higher but keep an eye on that cross.So next week looks like there may be a pullback or at least a rest for Gold and a rest or maybe a rise for the US Dollar Index. US Treasury Bonds are on support but look weak and headed lower. Although Oil looks strong it is at resistance and may need some time to work through it. Volatility seems to have found a bottom, although still weak, which should allow stocks to continue their move higher, towards a test of the top of the four month (or maybe one year) channel. Good luck next week!

No comments:

Post a Comment